Personal loans made easy.

You can easily take out a loan by

using the

using the  App. Benefit from short processing times and quick payouts. Loan amounts start at €1,000.

App. Benefit from short processing times and quick payouts. Loan amounts start at €1,000.That's how easy and fast it is. Ready for a loan?

There is no fee for the loan application and no fee for account management at OneFor.

Quick loan decision

If you upload all the required documents a loan decision only takes a few days.

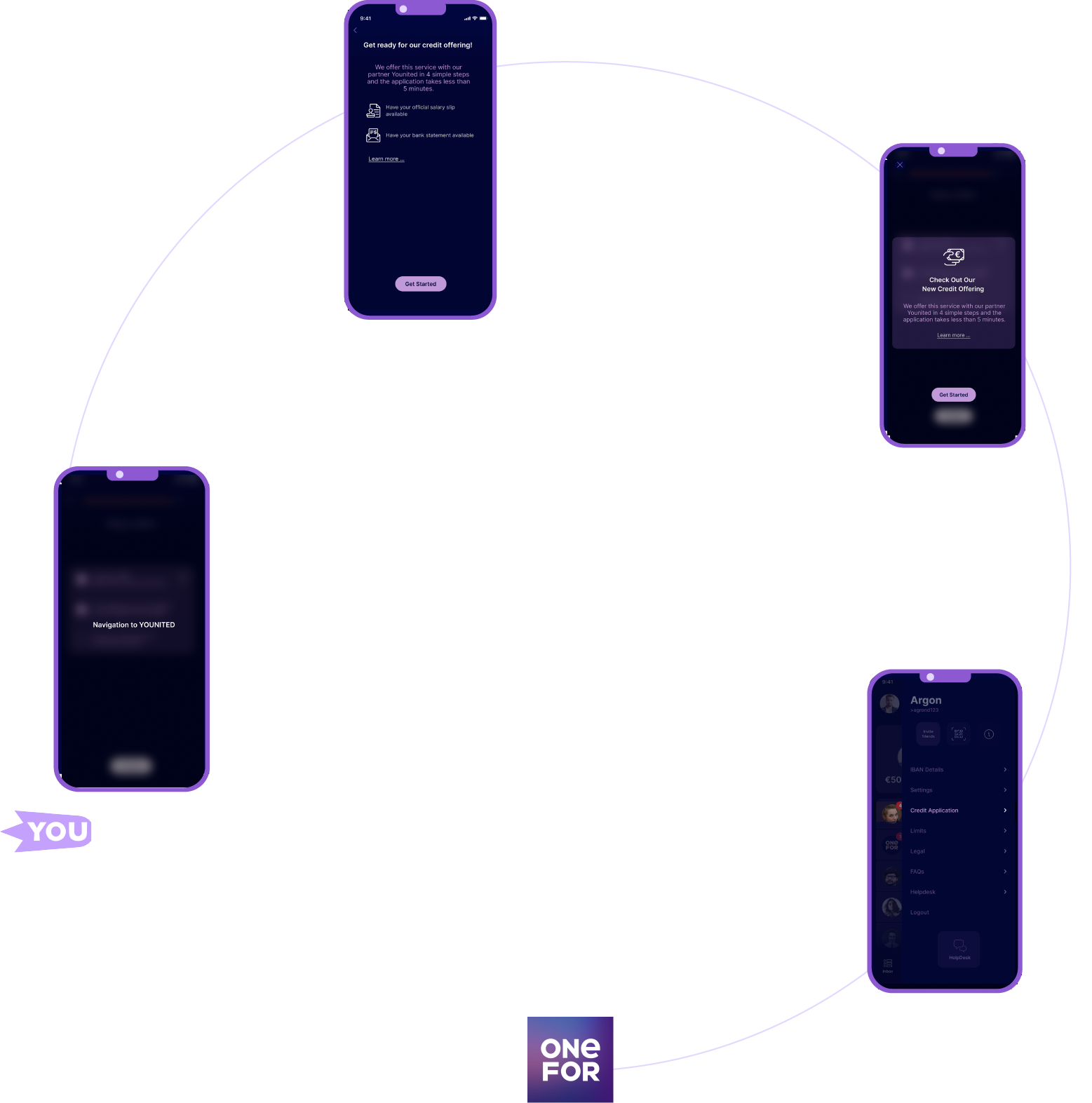

Steps to follow, and you are all set to experience OneFor app and apply for a loan

Get OneFor app.

Create your free OneFor account in minutes.

Quick loan decision

Once the completed loan application and required documents have been submitted, you will be contacted regarding the approval status of your application within 24 hours

Not a OneFor costumer yet? Open your OneFor FREE account in minutes, and you are ready to apply for a loan.

Frequently Asked Questions

To be eligible to apply for a loan provided by Younited Credit, through the OneFor app, you must provide the following documents while applying;

- Workers/employees/public service and trainees:

1. Complete payroll/remuneration statement

2. Last full month of bank statements

- Self-employed people, freelancers:

1. Tax assessment

2. Last full month of bank statements

- Pensioner:

1. Pension notice or pension notice

2. Last full month of bank statements

3. Proof of tax ID

The credit process at Younited Credit is 100% digital from start to finish. This saves long waiting times & time-consuming paperwork!

You will receive a response within 24 hours. You will be contacted regarding the approval status of your application within 24 hours.

To apply for a personal loan provided by Younited Credit through OneFor, you must first register to the OneFor App.

The application process is 100% online and is available only through the OneFor app.

• Click on the “Credit Application” button on the menu of your OneFor app

• The button will redirect you to the Younited Credit website. There, you can see a form for applying for a loan.

• Fill out the form with all the required information

The monthly interest rate is fixed*. No loan application fee or OneFor account maintenance fee.

Information according to §6a PAngV: Fixed interest rate between 1.87% and 13.51%, effective annual interest rate between 1.89% and 14.50%, net loan amount from €1,000 to €50,000, term from 12 to 84 months. Provided creditworthiness. Younited SA Germany branch, Rundfunkplatz 2, 80553 Munich. 2/3 Example: Net loan amount of €10,000, total amount €15,168.09, monthly. Installments €202.84, 72 installments, term 72 months, fixed interest rate 13.17%, effective annual interest rate 14.25%.

The loan amount ranges from €1,000 to €50,000, and the repayment period is from 6 to 84 months.

.png?width=86&name=Logo_Master%20(1).png)